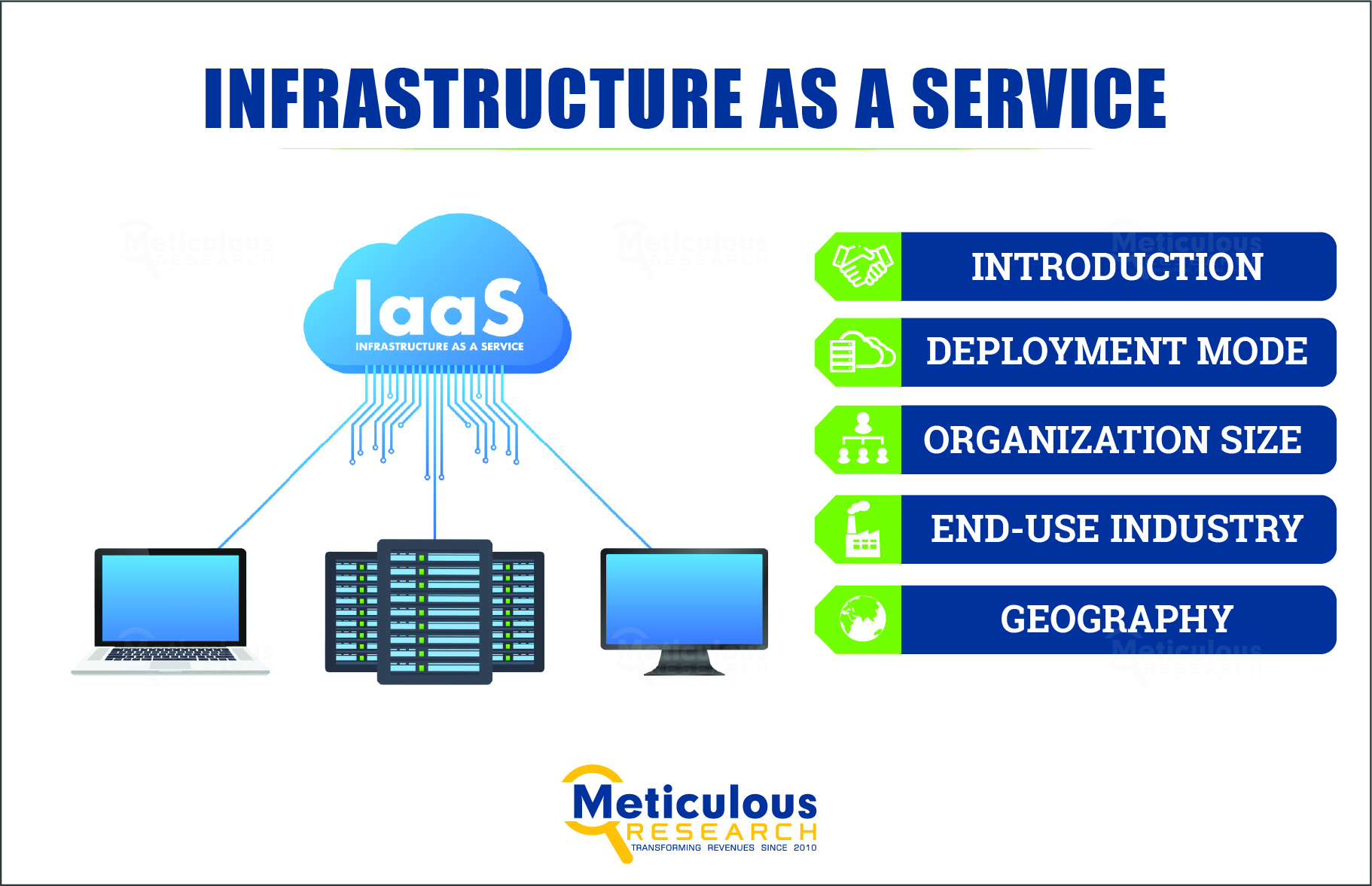

The Infrastructure-as-a-Service (IaaS) market is projected to reach $512.4 billion by 2031, growing at a compound annual growth rate (CAGR) of 23.1% from 2024 to 2031.

Growing Adoption of Cloud Infrastructure in the BFSI Sector

Cloud technology is gaining significant traction in the Banking, Financial Services, and Insurance (BFSI) sector as modern banks and financial institutions look for innovative ways to reduce operational costs and increase efficiencies. According to a 2020 survey by IBM Corporation, 91% of financial institutions actively used cloud services. The COVID-19 pandemic further emphasized the limitations of legacy systems, as banks were forced to meet consumer expectations in new and more efficient ways.

Increasing Cloud Adoption in the BFSI Sector

The BFSI sector generates vast amounts of data daily from customer interactions, transactions, and financial records. To manage this influx of data, financial institutions are increasingly turning to cloud computing services, particularly Infrastructure-as-a-Service (IaaS), which allows them to store, manage, and process data efficiently. Cloud migration offers numerous advantages, including enhanced customer relationship management, better decision-making through real-time data analytics, and streamlined operational processes.

In particular, the IaaS model has become a crucial component of this transformation, offering scalability and flexibility for banks. For example, law firms within the BFSI sector use IaaS to reduce costs by automating processes such as document management systems (DMS). These cloud-based DMS solutions provide secure storage for case documents, which can be easily accessed online, eliminating the need for extensive physical storage.

Download Sample Report Here: https://www.meticulousresearch.com/download-sample-report/cp_id=5448

Cloud for Regulatory Compliance and Operational Efficiency

One of the top priorities for financial institutions is regulatory compliance, especially when managing trading and risk. Banks face increasing pressure to meet complex market risk functions, liquidity requirements, and capital management regulations. Cloud computing offers scalable high-performance computing (HPC) resources, which can handle large volumes of data efficiently and meet these regulatory demands.

According to Google LLC, more than 49% of Tier 1 and Tier 2 banks are now focused on enhancing calculation speed and improving data quality to support risk and liquidity management functions. By leveraging cloud-based computational resources, financial institutions can achieve greater agility and efficiency, ensuring they remain compliant with regulations while improving overall performance.

The Hybrid Cloud Approach: Combining Security and Scalability

A recent survey by Google Cloud and The Harris Poll highlighted that 83% of respondents from the BFSI sector reported using cloud services in some capacity. Of these, 38% favored a hybrid approach, which combines the security and control of private clouds with the scalability and flexibility of public clouds. This approach is especially appealing to financial institutions, as it allows them to maintain strict control over sensitive data while benefiting from the cost and performance advantages of public cloud platforms.

Hybrid cloud solutions have proven to be particularly effective in the BFSI sector for several reasons. First, they provide enhanced security, enabling banks to store sensitive financial information in private cloud environments while taking advantage of the processing power and scalability of public clouds for less sensitive operations. Second, hybrid clouds allow financial institutions to scale their computing resources as needed, providing greater flexibility to adapt to changing market conditions and customer demands.

Check complete table of contents with list of tables and figures: https://www.meticulousresearch.com/product/infrastructure-as-a-service-market-5448

Key Benefits of Cloud Infrastructure in the BFSI Sector

1. Cost Reduction: One of the primary drivers for cloud adoption in the BFSI sector is the significant reduction in hardware installation and maintenance costs. Traditional on-premises infrastructure requires substantial investments in physical hardware, along with the ongoing costs of maintaining and upgrading these systems. Cloud infrastructure, on the other hand, eliminates the need for large-scale physical data centers, reducing capital expenditure and operational costs.

2. Scalability: Cloud computing offers unparalleled scalability, enabling banks and financial institutions to increase or decrease their computing resources based on demand. This is especially important for institutions with fluctuating workloads, such as during periods of high trading activity or financial reporting deadlines. With cloud infrastructure, banks can quickly scale up their resources to handle peak loads and scale down during quieter periods, optimizing efficiency and cost.

3. Accessibility and Flexibility: Cloud services allow employees to access critical systems and data from anywhere, providing greater flexibility in operations. This remote accessibility has become even more important in the wake of the COVID-19 pandemic, as many financial institutions were forced to transition to remote working models. Cloud infrastructure ensures that employees can continue to work efficiently, regardless of their location, by providing secure access to essential tools and systems.

4. Enhanced Data Analytics and Decision-Making: Cloud infrastructure supports advanced data analytics, enabling financial institutions to make data-driven decisions more quickly. By processing large volumes of data in real-time, banks can gain valuable insights into customer behavior, market trends, and financial performance. These insights allow institutions to respond more effectively to changing conditions, improve customer service, and optimize their operations.

5. Improved Customer Relationship Management (CRM): Cloud-based CRM solutions enable financial institutions to better understand and manage customer interactions. By consolidating customer data into a single platform, banks can gain a comprehensive view of their customers’ needs and preferences, allowing them to offer more personalized services and enhance customer satisfaction. Real-time data access also enables quicker response times to customer queries and issues, further improving the customer experience.

Cloud Infrastructure’s Role in Digital Transformation

Digital transformation is a key focus for the BFSI sector as institutions strive to remain competitive in a rapidly evolving financial landscape. Cloud infrastructure plays a central role in this transformation, providing the foundation for modernizing IT systems and supporting the development of innovative digital banking applications. By migrating existing IT infrastructure to the cloud, financial institutions can reduce costs, improve efficiency, and drive business growth.

Moreover, cloud platforms offer advanced tools for developing and deploying new digital services, such as mobile banking apps, AI-driven chatbots, and blockchain-based solutions. These technologies enable banks to enhance their offerings, attract new customers, and remain competitive in an increasingly digital world.

Conclusion

The growing adoption of cloud infrastructure in the BFSI sector is driven by the need to reduce costs, improve operational efficiency, and stay competitive in the digital age. Cloud computing, particularly the IaaS model, provides financial institutions with the scalability, flexibility, and cost savings required to meet these objectives. Hybrid cloud solutions offer an attractive balance between security and scalability, allowing banks to protect sensitive data while leveraging the benefits of public cloud services.

As regulatory compliance and operational efficiency remain top priorities, cloud infrastructure is becoming an essential tool for financial institutions to meet these challenges. By embracing cloud technology, the BFSI sector can continue to innovate, improve customer service, and achieve sustainable growth in an increasingly digital world. The transition to cloud infrastructure will not only enhance the performance of financial institutions but also enable them to adapt to future technological advancements and evolving consumer expectations.

Quick Buy: https://www.meticulousresearch.com/Checkout/55080639

Infrastructure-as-a-Service Market Research Summary

| Particulars | Details |

| Number of Pages | 211 |

| Format | |

| Forecast Period | 2024–2031 |

| Base Year | 2023 |

| CAGR (Value) | 23.1% |

| Market Size (Value) | USD 512.4 Billion by 2031 |

| Segments Covered | By Offering

By Deployment Mode

By Organization Size

By Application

By Sector

|

| Countries Covered | North America (U.S., Canada), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), Europe (U.K., Germany, Italy, Spain, France, Rest of Europe), Latin America and the Middle East & Africa |

| Key Companies | Amazon Web Services, Inc. (U.S.), Microsoft Corporation (U.S.), Alibaba Cloud (China), Google LLC (U.S.), Huawei Technologies Co., Ltd. (China), Oracle Corporation (U.S.), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), VMware, Inc. (U.S.), Rackspace Technology, Inc. (U.S.), DigitalOcean LLC (U.S.), Hewlett Packard Enterprise Company (U.S.), Tencent Cloud (China), Linode LLC (U.S.), NTT Communications Corporation (Japan), Utho (India), and Vultr (U.S.)

|

About Meticulous Research®

Meticulous Research® is a leading provider of comprehensive market intelligence, offering actionable insights and analysis across various industries. Our reports empower businesses to make informed decisions, drive growth, and remain competitive in a rapidly evolving marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

USA: +1-646-781-8004

Europe : +44-203-868-8738

APAC: +91 744-7780008

Email- sales@meticulousresearch.com

Visit Our Website: https://www.meticulousresearch.com/

Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research